If you have a car with a salvage title, you could take it to the dealership for them to appraise its value for you. In general, salvage vehicles are worth between 20% and 40% less than their Kelley Blue Book value. With that, it’s a good idea to get a salvaged vehicle appraised privately to determine its value accurately. So, total depreciation of $45,000 spread across 15 years of useful life gives annual depreciation of $3,000 per year. 60% depreciation is reported over https://www.bookstime.com/ 6 years and salvage value is 40% of the initial cost of the car.

Comparing Salvage Value to Other Values

A car with a salvage title or rebuilt title can be worth thousands of dollars less than a comparable car with a clean title. A lease buyout is an option that is contained in some lease agreements that give you the option to buy your leased vehicle at the end of your lease. The price you will pay for a lease buyout will be based on the residual value of the car. Though residual value is an important part in preparing a company’s financial statements, residual value is often not directly shown on the reports.

Formula and Calculating Straight Line Basis

Many business owners don’t put too much thought into an asset’s salvage value. The depreciation journal entry accounts are the same every time — a debit to depreciation expense and a credit to accumulated depreciation. The Internal Revenue Service (IRS) uses a proprietary depreciation method called the Modified Accelerated Cost Recovery System (MACRS), which does not incorporate salvage values.

- Other times, it’s about figuring out how much it’s worth when it’s done for good, minus the cost of getting rid of it.

- For example, there is always a risk that technological advancements could potentially render the asset obsolete earlier than expected.

- Briefly, suppose we’re currently attempting to determine the salvage value of a car, which was purchased four years ago for $100,000.

- For tax purposes, the depreciation is calculated in the US by assuming the scrap value as zero.

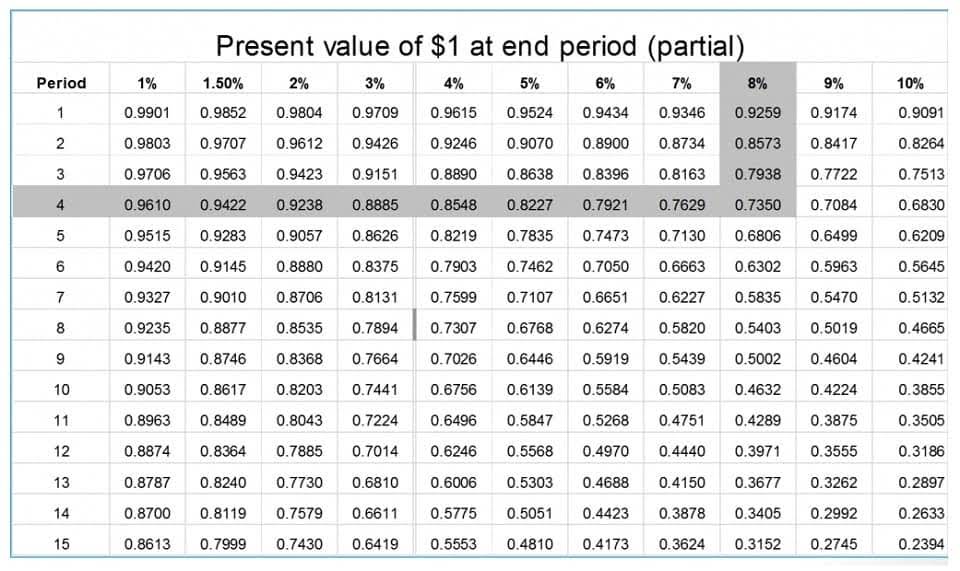

- To calculate depreciation using a straight-line basis, simply divide the net price (purchase price less the salvage price) by the number of useful years of life the asset has.

- It depends upon the vehicle, its damages and how much it is worth in its current state after it’s determined a total loss.

- However, determining the exact value of a salvage vehicle often requires some legwork.

Fixed Asset Salvage Value Calculation Example (PP&E)

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. You can still calculate depreciation without a salvage value; just put a $0 in any place where you need to enter a salvage value. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. J.B. Maverick is an active trader, commodity futures broker, and stock market analyst 17+ years of experience, in addition to 10+ years of experience as a finance writer and book editor. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. The beginning balance of the PP&E is $1 million in Year 1, which is subsequently reduced by $160k each period until the end of Year 5.

- The money I get back on my old phone is known as its salvage value, or its worth when I’m done using it.

- Each company has its way of guessing how much something will be worth in the end.

- The assumption made by accountants is that the asset loses the same value over each period.

- Unless there is a contract in place for the sale of the asset at a future date, it’s usually an estimated amount.

- Salvage value is defined as the book value of the asset once the depreciation has been completely expensed.

How is Salvage Value used in Depreciation Calculations?

While you might be able to get your insurer to increase the salvage value of your car, it likely won’t be enough to cover a new vehicle purchase. Depending on your state laws, you might be able to buy back the damaged car from the insurance company. It depends upon the vehicle, its damages and how much it is worth in its current state after it’s determined a total loss. To determine the residual value of an asset, you must consider the estimated amount that the asset’s owner would earn by selling the asset (minus any costs that might be incurred during the disposal).

How to Calculate Salvage Value

Unless there is a contract in place for the sale of the asset at a future date, it’s usually an estimated amount. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. When you’re using straight-line depreciation, you can set up a recurring journal entry in your accounting software so you how to get salvage value don’t have to go in and manually prepare one every time. Annual straight line depreciation for the refrigerator is $1,500 ($10,500 depreciable value ÷ seven-year useful life). Liquidation value is usually lower than book value but greater than salvage value. The assets continue to have value, but they are sold at a loss because they must be sold quickly.

- While you might be able to get your insurer to increase the salvage value of your car, it likely won’t be enough to cover a new vehicle purchase.

- Both declining balance and DDB require a company to set an initial salvage value to determine the depreciable amount.

- A company uses salvage value to estimate and calculate depreciation as salvage value is deducted from the asset’s original cost.

- ABC expects to then sell the asset for $10,000, which will eliminate the asset from ABC’s accounting records.

- The buyer will want to pay the lowest possible price for the company and will claim higher depreciation of the seller’s assets than the seller would.

- If you decide to buy your leased car, the price is the residual value plus any fees.

Salvage value is the estimated resale value of an asset at the end of its useful life. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. The salvage price of the asset and scrap value calculation are based on the original price and depreciation rate.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- An example of this is the difference between the initial purchase price of a brand new business vehicle versus the amount it sells for scrap metal after being totaled or driven 100,000 miles.

- Book value and salvage value are two different measures of value that have important differences.

- J.B. Maverick is an active trader, commodity futures broker, and stock market analyst 17+ years of experience, in addition to 10+ years of experience as a finance writer and book editor.

- Say that a refrigerator’s useful life is seven years, and seven-year-old industrial refrigerators go for $1,000 on average.

The carrying value is what the item is worth on the books as it’s losing value. In accounting, an asset’s salvage value is the estimated amount that a company will receive at the end of a plant asset’s useful life. It is the amount of an asset’s cost that will not be part of the depreciation expense during the years that the asset is used https://x.com/BooksTimeInc in the business.