We building their own blog post body type blog post physical stature household (barndominium otherwise shouse provided) need some level of article frame household structure financing. (shouse=shop+house)

This can be one of the few instances when I would suggest playing with an over-all builder however, only if your own lender will not allows you to care about-create

Intend on trying to find at least a good 20% down payment. Sometimes, in the event the house is totally free and obvious, certain or each one of land-value enforce on the down fee.

Your lender’s guarantee is dependant on any type of try least prices or done appraised really worth. Be suspicious specific circumstances otherwise inclusions features a greater rates than simply its complete appraised well worth.

Borrower/builder needs draws as needed to pay for information and you can work completed. When you look at the a meeting a broad company are leased, dont offer your partner immediate access so you can loans as opposed to your being forced to approve.

While it songs best to create a post frame household getting your specific wants and requirements, processes off applying for and you may closure a construction financing requires a much better relationship of your time and you can money versus investment an existing home with a traditional Conventional Financial. This is because men and women banking companies financing structure loans are investing a great significant share on the an enthusiastic intangible house, one to not even present. As such, their needs to have files and you can a greater down payment out-of client is actually greater than if they was basically financial support an already established family.

An individual romantic structure loan are a single loan money property acquisition and you will blog post physical stature house structure, they functions as continuous resource as well. Because this financial was getting a leap regarding faith your house is situated while the advertised which have plans and you will criteria these are typically given, these include still providing a risk home based consumer and builder. If one thing fails during the design, they might end up being lien holder on a partly developed blog post frame house. Just like the banking companies aren’t in the business to build property, they mitigate that it chance billing highest interest levels to your design funds. Best risk to a lender closure a housing loan has possibly creator or consumer default through the design and better pricing ensure it is these to spread it risk.

A two Action loan differs as household client often intimate on one to loan exclusively accustomed money belongings purchase and house build. Once finished, blog post physique resident refinances framework financing having a long-term old-fashioned mortgage of its opting for.

Each other single romantic and two action mortgage has its line of gurus and you can drawbacks and each individual family customer/creator has to evaluate those to determine that is greatest. When you find get a small loan bad credit yourself a single personal loan merely demands a borrower so you’re able to sign you to definitely selection of financing data and they’ve got that financing level each other design and you will overall home financing, costs at the closure try any where from .twenty five so you can .5% higher than a traditional old-fashioned mortgage are. Again, it is because structure lender’s added exposure. Two-step loans promote visitors a capability to prefer (shortly after completion) a permanent financing of its preference. Generally this is exactly at the a reduced speed than a conventional loan, but a couple of loan closings produce a couple of sets of settlement costs, a few signings, etcetera.

Dont get the loan telling the potential financial it is an effective barndominium, rod barn/strengthening or post physique family, an such like

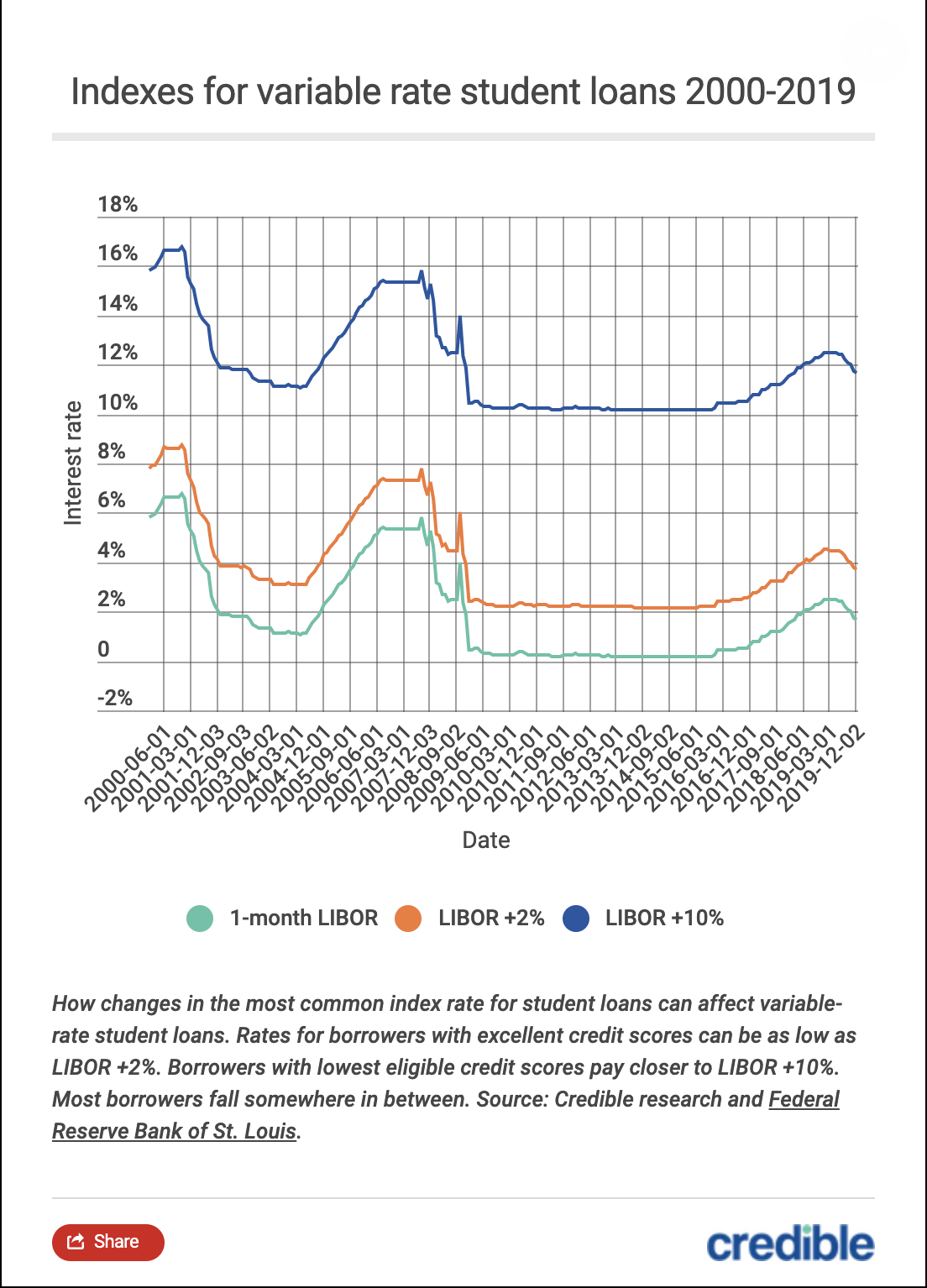

Parameters a blog post physique citizen should consider were period of time they plan to keep the family, current rate of interest ecosystem (is actually costs ascending otherwise dropping?) as well as their own risk endurance knowing rates can also be and probably usually sometimes increase otherwise off as residence is becoming situated.