Blogs

When using the Martingale approach in the Foreign exchange market, you should are still diligent and self-disciplined. While in the shedding streaks, you must stay calm and you will follow the means. Looking forward to industry to contrary is the key section away from this plan. Productive money government means that you can enjoy the brand new thrill out of betting if you are minimizing the risk of tall financial losings. While the Martingale program also have thrill and you can possible quick-name gains, you will need to address it responsibly. Participants is always to lay strict loss constraints and prevent chasing losses beyond the way to ensure a positive gambling sense.

- Martingale the most popular roulette procedures there is certainly.

- The fresh Martingale approach within the trade is a fascinating equipment for handling ranking.

- The new 0 and you can 00 to your roulette wheel were introduced in order to break Martingale’s technicians giving the overall game a lot more you can outcomes.

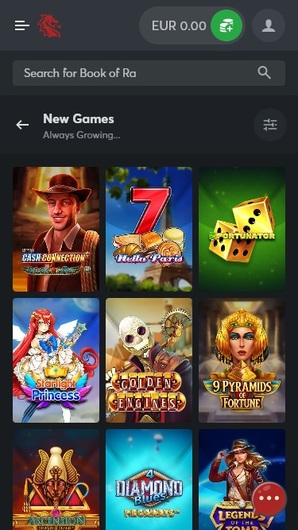

Casino Uberlucky review – Equal Weighting Status Sizing: Definition, Meaning And you can Example

To own a situation with the same probability, including a money toss, there have been two opinions on how to size a trade. The newest Martingale Approach casino Uberlucky review states this have to twice as much proportions given a loss. The idea at the rear of the strategy is that you win back almost any’s started missing. Likewise, an enthusiastic anti-Martingale Strategy states this one need enhance the exchange size offered a victory. The message provided with Binomo Website does not include economic advice, advice or information when deciding to take, or perhaps not when planning on taking, any positions, opportunities otherwise decisions regarding people number.

- Manner in the Forex and other areas can last for a good very long time, therefore it is hard to predict otherwise do threats while using procedures for example Martingale.

- The opposite Martingale method, reverse of one’s Martingale while the identity means, are a medium chance means.

- Note that you already doubled the brand new choice because the for each and every hands will demand a share.

- It will guide you in making far more informed choices regarding the when so you can cash out your earnings based on some items such current freeze points and choice models.

- This really is from the having a backup bundle planned in case your martingale trade happens southern area.

Reverse Martingale

The fresh attract of your Martingale method is dependant on its possible to own quick recovery and you will profit, but it’s fraught which have high dangers. One of the first risks ‘s the possibility to get rid of a whole exchange account throughout the a prolonged dropping streak. The need to continuously double the reputation proportions can easily exhaust their financing, particularly in volatile locations, putting some martingale program a dangerous approach. The theory try to start with designed for gambling, and is according to the analytical negative effects of an event that have a fifty% probability of it taking place, including winning a trade. However, this tactic deal high threats, similar to those who work in playing. So you can avoid that it, specific investors choose the contrary Martingale strategy, growing bet immediately after gains and you may decreasing her or him immediately after losses.

Do you know the Will set you back of the Martingale System within the Trading and investing?

I’ve in addition to known the benefits of with the strategy and you will the risks inside it. As a result, even though it might be an incredibly profitable, there’s a probabilities you to definitely losses is going to be rather high. Therefore, this tactic is usually useful for people that have plenty of money. Inside trend pursuing the, buyers go into enough time otherwise brief positions once they believe that a good trend is evolving. Inside the hedging, they unlock a few correlated otherwise uncorrelated ties with the expectation you to definitely the new investments have a tendency to protect its investments. The newest martingale system depends on possibility—the chance that just the right second, you can hit the best mixture of result and you may investment and make everything you back plus much more.

Martingale Change Strategy During the a loss of profits Move

After all, the brand new Martingale doesn’t increase the opportunity or change the house boundary in just about any way. Sure, in theory, for individuals who double your own choice after each and every loss, once you perform ultimately victory, might, in reality, recover your entire losings, along with a profit. However in fact, this can lead to huge bets and possibly dreadful losings. Within this situation, you place a good tool every single losings, enhancing the winnings if you earn. Your exposure high loss and wager constraints and certainly will burn off as a result of all bankroll quickly for the an extended shedding move. You lose about three bets consecutively, following earn to your next to bring your own money to as well as $20.

Form such restrictions assists avoid losing your entire money and you may assurances a more managed method of exchange. Increasing wagers after loss creates severe mental pressure on the individual. Per after that wager grows more tall, and the fear of losing a huge share can cause mental choices, that may exacerbate the situation. Maintaining composure and you may purely pursuing the means lower than such requirements means significant work and you can self-handle. The greatest exposure on the Martingale strategy is the opportunity of a set out of losses that may trigger nice losses. The brand new Martingale method is difficult to make usage of, specifically for beginner investors just who may possibly not be accustomed industry style or even the points that affect speed moves.

This strategy relies on the assumption your industry will eventually submit the brand new trader’s like, and they’ll have the ability to get well their losses and then make money. The brand new Martingale technique is a famous gambling program you to definitely originated in 18th-millennium France and you may attained stature in the wonderful world of gaming. They spins around the notion of increasing your own wager after each and every losses, to the aim of sooner or later curing all of the earlier loss and you will to make an income. Inside forex trading, the fresh Martingale technique is used from the doubling the position size once per shedding trade. The new martingale system is a strategy to help you enhance the chance of getting over losing lines which can be used inside using or gambling. It involves increasing through to dropping bets and you may cutting effective wagers because of the 1 / 2 of.