In the Harrison

Harrison Enter was a writer and a digital nomad, focusing on personal funds having a look closely at playing cards. He could be a scholar of your College or university of Vermont from the Chapel Slope having a major from inside the sociology that is currently travelling the country.

A home Equity Credit line (HELOC) shall be a helpful economic equipment to own property owners, letting them availability financing in accordance with the security he has manufactured in their houses. However, it is vital to know how good HELOC can affect your credit score. In this post, we shall discuss different means an effective HELOC may affect your borrowing and offer guidelines on how to replace your borrowing from the bank playing with a great HELOC while to avoid any negative outcomes.

- Perception regarding HELOC on your borrowing from the bank

- Enhancing your borrowing having fun with a good HELOC

- How to prevent an effective HELOC from injuring the borrowing

Effect of HELOC on the borrowing

An effective HELOC may have each other positive and negative effects in your credit history. Skills these types of impacts is extremely important getting managing your own borrowing wisely.

step 1. Obtaining an effective HELOC

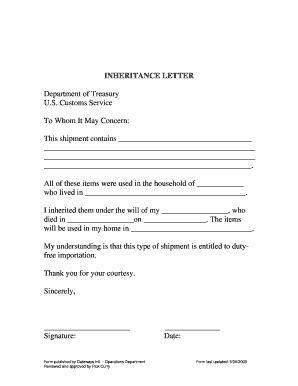

![]()

When you apply for an effective HELOC, the lending company will most likely carry out a hard query on your borrowing report. This query might have a short-term negative effect on the borrowing from the bank score, normally minimizing they by a few items. Yet not, this new perception is commonly minimal and small-resided. It is essential to keep in mind that numerous hard concerns within a preliminary several months, for example while shopping available for an educated HELOC terms, may have an even more significant affect your own credit.

dos. Using the HELOC

Once you have become accepted to possess good HELOC, how you put it to use may affect your credit score. If you utilize money responsibly and make timely repayments, it can has a positive effect on their borrowing. Making uniform costs towards your HELOC shows responsible borrowing management and you can will help change your credit rating over time.

In addition, if you maximum your HELOC otherwise create later repayments, it does has actually a terrible influence on their credit. Highest credit usage, which is the portion of offered borrowing you are having fun with, is lower your credit rating. Concurrently, later otherwise missed payments is stated in order to credit agencies and you will somewhat harm the borrowing.

step 3. Closure the new HELOC

Closure a beneficial HELOC may affect your credit score. When you romantic a line of credit, it decreases the quantity of offered credit you have got, which can impact your own borrowing from the bank utilization ratio. When you yourself have almost every other borrowing levels, including playing cards, keeping the lowest borrowing usage ratio is essential to own a healthier credit history. Therefore, closure a good HELOC can result in a temporary reduced amount of their credit score, particularly when it absolutely was a serious percentage of the available credit.

Simple tips to change your borrowing having fun with a great HELOC?

When you’re an effective HELOC may affect your credit rating, it is also used strategically to change their credit character. Here are some ideas:

- Utilize the HELOC responsibly: Make repayments on time and avoid maxing the actual available borrowing to maintain a wholesome credit utilization ratio.

- Combine high-appeal personal debt: Consider using the cash out of good HELOC to pay off higher-attention debt, like credit card balance. It will help reduce your overall borrowing from the bank utilization and change your credit score.

- Introduce a payment records: Constantly and make payments towards your HELOC might help present a confident commission background, that’s a vital reason behind credit reporting designs.

How will you end a HELOC out of harming your borrowing from the bank?

- Obtain responsibly: Merely borrow what you want and can conveniently pay. End maxing out your HELOC otherwise taking up even more debt than just you could potentially carry out.

- Build repayments promptly: Quick repayments are vital to keeping a good credit score. Created automatic repayments otherwise reminders to make certain you never skip a payment.

- Display screen your borrowing from the bank utilization: Maintain your borrowing application proportion low by steering clear of excess borrowing against your own HELOC. Seek to ensure that it it is below 30% to steadfastly keep up a healthier credit reputation.

What takes place on my credit if i cannot faucet the latest HELOC very often?

When you have a good HELOC but do not utilize it apparently, it can nevertheless impact your credit score. This new bare credit limit results in your own offered borrowing, which helps lower your borrowing from the bank application ratio. This may possess a positive influence on your credit score. But not, in the event the HELOC stays inactive for an extended period, the lending company may want to close it, that lower your offered credit and potentially lower your Repton payday loan and cash advance borrowing from the bank score.

Why does a good HELOC affect credit usage ratio?

A good HELOC make a difference their borrowing from the bank usage ratio if you obtain against it. Since you play with money from your HELOC, the latest a great harmony develops, that may increase your borrowing use proportion. It’s important to control your borrowing from the bank cautiously to get rid of maxing out the HELOC and you may negatively affecting your credit score. Maintaining the lowest credit application proportion is generally beneficial for their borrowing.

What is the lowest credit score having good HELOC?

The minimum credit score required to qualify for a good HELOC varies among loan providers. Though some loan providers could possibly get believe individuals that have credit scores since lower as the 620, you will need to remember that highest credit ratings typically trigger a lot more favorable terms and you may interest levels. Loan providers contemplate other factors, like your money, debt-to-money proportion, and family collateral, whenever researching the qualification having an excellent HELOC.

Will it be much harder to find an effective HELOC than home financing?

Obtaining good HELOC is generally much easier and you may smaller than simply providing a beneficial mortgage. HELOCs is safeguarded because of the equity of your house, and that decreases the lender’s chance compared to the a personal bank loan. The program process to own a good HELOC always pertains to a credit score assessment, income confirmation, and you will an assessment of your own property’s well worth. If you’re criteria may differ, the new HELOC process tends to be smaller advanced and you will date-consuming than simply a home loan app.