Building an effective accounts receivable management is critical to maintaining a positive cash flow and fostering a successful customer relationship. It involves a range of tasks like onboarding new customers, evaluating their creditworthiness, issuing invoices on time, and timely collection of payments. Accounts receivable management is an essential part of maintaining healthy cash flow. A streamlined and efficient process prevents existing capital from going to waste. This can put your business in a better position to reduce debt, lower costs, drive growth, and outperform your competitors.

Accounts receivable (AR) refers to the money owed to a business by its customers for goods or services that have been provided but not yet paid for. It is an essential aspect of a company’s financial management, as it directly impacts cash flow and overall financial health. AR is considered a current asset on a company’s balance sheet and is used to evaluate its liquidity and ability to cover short-term obligations. Poor management of accounts receivables refers to the various operation and financial issues of business that impact the receivables management efficiency . Some of the common drivers are late invoices, higher DSO, data discrepancies, inadequate credit checks, time consuming manual processes, etc.

Outline Clear Billing Procedures

This ensures strong cash flow and can strengthen your customer relationships. Implementing efficient invoice management systems can lead to improved cash flow and a higher accounts receivable turnover ratio, indicating that customers are paying promptly. Accounts receivable (AR) is the balance of money owed to a company by its customers for goods or services purchased on credit. These receivables are considered an asset on the company’s balance sheet, as they represent the future cash inflow expected from customers. When a client buys goods or services on credit, they receive an invoice, which they will pay after a specified period. Most companies only send a customer balance or memo without listing the outstanding invoices.

There are a few big advantages to managing cell phone depreciation has your phone lost worth your accounts receivable effectively. For one, it can help you optimize your cash flow and increase your working capital. Automating your accounts receivable can also help reduce the administrative burden of managing it, such as sending automated reminders, invoicing, and tracking payments. If your accounts receivable balance is going up, that means you’re invoicing more.

- Companies can’t fix what they can’t measure, which is why companies must evaluate their AR performance to accurately assess their accounts receivable management performance.

- Implementing efficient invoice management systems can lead to improved cash flow and a higher accounts receivable turnover ratio, indicating that customers are paying promptly.

- In this equation, accounts receivable is considered an asset as it indicates the expected cash inflows a company is due to receive.

- More payment methods can reduce late payments and foster a healthy cash flow.

Nonetheless, it’s crucial to navigate the legal and compliance landscape surrounding accounts receivable to avoid pitfalls and ensure regulatory adherence. This section outlines the prominent legal and what are the types of transaction in accounting ethical factors that businesses need to consider while handling accounts receivable. In extreme cases, a high level of uncollected AR could lead to bankruptcy.

AR process transformation that pays for itself

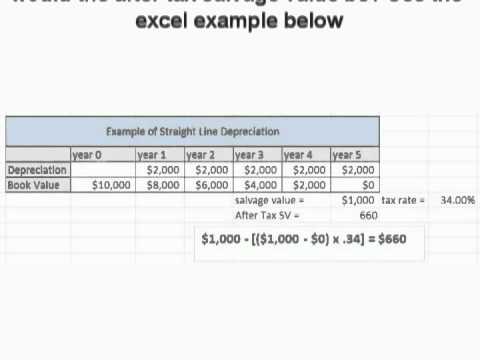

Companies may need to redesign their AR processes to ensure optimal success. From there, they should automate every step possible to fully realize the benefits of AR transformation. In this example, a client settles a $1,000 invoice, resulting in a decrease in accounts receivable and a corresponding increase in cash. Unlock cash on your balance sheet that can be used to fund what is going concern growth and/or improve the liquidity of your organization. Another option for encouraging clients to pay invoices on time is to charge late fees. A typical aging schedule groups invoices by their number of days outstanding, such as 0-30 days, days, days, and over 90 days.

factors that complicate accounts receivable management

It is best practice for a business to be discrete about which customers they will extend credit terms to when drafting a credit policy. Those pressures have only intensified with the dramatic rise in inflation that followed and a looming global recession. We provide third-party links as a convenience and for informational purposes only.

If the balance is going down, that means you’re collecting customer payments from previous invoices. Receivables management includes creating and following standards and practices for your business to facilitate efficient billing and payment for your clients. Done efficiently, you’ll receive timely payments, happy client relationships, and high liquidity for your business. Poor management, however, can lead to wasted staff time, accounting errors, lost revenue, and poor cash flow.

Most payment issues you’ll encounter are because clients have trouble receiving, viewing, or understanding your invoices, or because they don’t have access to a quick and convenient payment method. This automates your record-keeping, so there’s less for you to keep track of and decreases the chances of human error. Finally, optimized AR management creates a more efficient accounting team focused on strategic initiatives rather than administrative duties. The experienced team of AR professionals and robust software of Corcentric’s O2C solutions mitigate issues before they escalate. If a dispute occurs, our Managed AR team handles resolution, only involving your team when necessary.